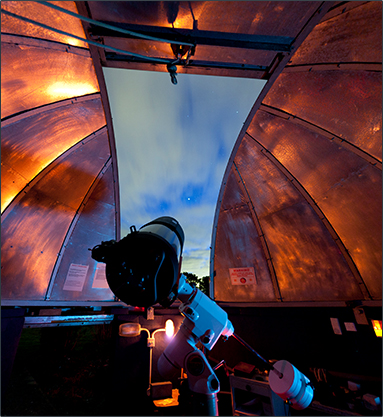

We view risk management through the wide lens of a long-term investor and owner of a business, rather than through the narrow lens of short-term stock price volatility. In our opinion, as investors expand their time horizon, short-term volatility should minimize in importance while the performance of the underlying business or asset, and the ultimate gain or loss in capital, matters more.

Margin of Safety is Linked to the Quality of the Business

While many investors seek a margin of safety by focusing primarily on lower valuation metrics, we believe that a high-quality business provides the key margin of safety over the long term. Quality, exhibited in multiple forms, provides a more durable form of safety. Importantly, quality can also provide long-term growth potential. We believe owning innovative industry leaders with competitive advantages and strong business models increases the quality profile of a business and reduces risk.

Qualities we look for in businesses held in client portfolios include: market leadership, competitive advantages, unique talent and culture, and industry-leading innovation. While valuation is a key component of our analysis, we believe quality provides the ultimate margin of safety.

Pictured is the telescope at the Norman Lockyer Observatory in the UK. We view risk management through the wide lens of a long-term investor.