Part Two of a Three-Part White Paper Series

By Thomas Ricketts, CFA

The two primary principles or approaches to investing revolve around the disciplines of Value and Growth investing. The debate over which discipline is superior has gone on for decades, and the survival of both approaches proves the point that they both have merit. This debate is stale, as great managers on either side utilize aspects of the other. Successful value managers find companies that see a rebound in earnings power and thereby benefit from a type of growth, while growth managers experience success when they find sustainable growers and don’t overpay for this growth. Said another way, value investors can always rely on the emotions of Mr. Market creating value opportunities, while growth managers will always be able to take advantage of the emergence and growth of new industries. Both approaches are needed for well-functioning markets.

These two investing approaches are foundational, and yet seem less effective than in the past. Why? And, are these two approaches in their current form the only “organizing principles” that investors should rely on to find and evaluate investments? No. Has their almost uniform and formulaic application led to creeping mediocrity among active managers versus the passive index approach? Maybe. If these approaches are less effective, are there other ways to discover investment opportunity, and are there other principles and approaches that may enhance the old traditions? I believe so and will share an overview of a new approach that builds on many of the core principles of the growth and value disciplines, but adds a new framework, called Evolutionary Investing.

The foundation of Evolutionary Investing is the belief that an evolutionary approach to research and managing investment portfolios is the best organizing principle for making sense of changes in technologies and industries, their trajectories and trends, and their potential future path of growth and profit. This approach addresses some of the limitations of traditional approaches.

We all feel this process of innovation and evolution all around us, and intuitively know its power, even if the process is not well understood. For this reason, it is time we made these evolutionary dynamics a core part of the investment research process and elevated them to the proper level within the pantheon of investing principles.

Inspiration from Nature’s Innovation

The greatest innovator of all time is not Thomas Edison or Steve Jobs, but nature, with its millions of species that have evolved since the beginning of life. Nature invented the eye with its exquisite optical powers, the aerodynamic ability of wings for flight, and microscopic genes for replicating information that are passed down through generations of species. Einstein once said, “Look into nature. And then you will understand everything better.” We have much to learn from Mother Nature and her process of innovation.

In an economy, and for industries, experiencing accelerating change, the old frameworks for understanding business, modeled on a mechanistic industrial world, are becoming less effective. Adam Smith’s The Wealth of Nations was first published in 1776 at the beginning of the First Industrial Revolution, while Taylorism in the late 1800s and the industrial assembly line of Fordism in the early 1900s marked the zenith of pushing mechanistic thinking during the Second Industrial Revolution. The industrial logic of these previous ages, which still informs most investor thinking to this day, is giving way to the economic logic playing out in the accelerating transition to the Digital Age, forcing a new worldview.

In contrast to the mechanistic thinking of the twin Industrial Revolutions, the changes we are seeing in the Digital Age are increasingly fluid, organic, and often bottom-up, or as they say in scientific circles, “emergent.” These types of changes benefit from using a biological metaphor as the primary framework to understand and comprehend their true underlying dynamics. And there is no more universal and effective way of describing the biological world than the theory of evolution.

Most businesspeople would intuitively agree that at a high level the ideas of evolution seem to fit, though they may be skeptical of its usefulness at a granular or practical level. Some of the metaphors of evolution and ecology have been widely used for decades, indicating some utility of this type of thinking. We increasingly use such words or phrases as: ecosystems, differentiation, greenfield opportunity, going viral, and more recently, Cambrian explosion. We are using these evolutionary and ecological descriptions more now because they increasingly fit the actual dynamics of most industries today. Intuitively, we sense a new logic or language is needed to comprehend the changes impacting us, our businesses, and our investments.

The Economy as a Bottom-Up Emergent Process Driven by Technology and Innovation

Evolution is defined in general terms as an unfolding over time. It is not cyclic change; rather, it is novel change, generating new forms amidst changing environments over time. Merriam-Webster’s dictionary defines evolution as “1) A process of continuous change from a lower, simpler, or worse to a higher, more complex, or better state, or 2) Descent with modification from preexisting species: cumulative inherited change in a population of organisms through time leading to the appearance of new forms.”

It is important to note that the evolution or evolutionary change concept I am emphasizing here does not relate to incremental change only. Rather, evolution relates to the process of change, be it incremental or radical, that is driven by novelty, selection, and retention. This process leads to fundamental structural changes in populations, be it species, technologies, or industries. The economic future is different from the past precisely because it is built up, progressive, and ultimately generates profound novelty and invention, the kind that creates entire new industries.

This is in stark contrast with neoclassical economic models that focus on aggregate statistics and simple supply-demand curves and overemphasize equilibrium economics and reversion to means. While these models certainly have a role in the short-term and intermediate-term dynamics of many industries, they are less useful, even impotent at times, in their explanatory power for the evolution of technology and an increasing number of industries. Thus, they come up short in providing valuable insight into our changing economy. Traditional neoclassical economics, and frameworks built from it, are failing us. We need an updated approach to economics, which in turn creates an updated foundation for investing.

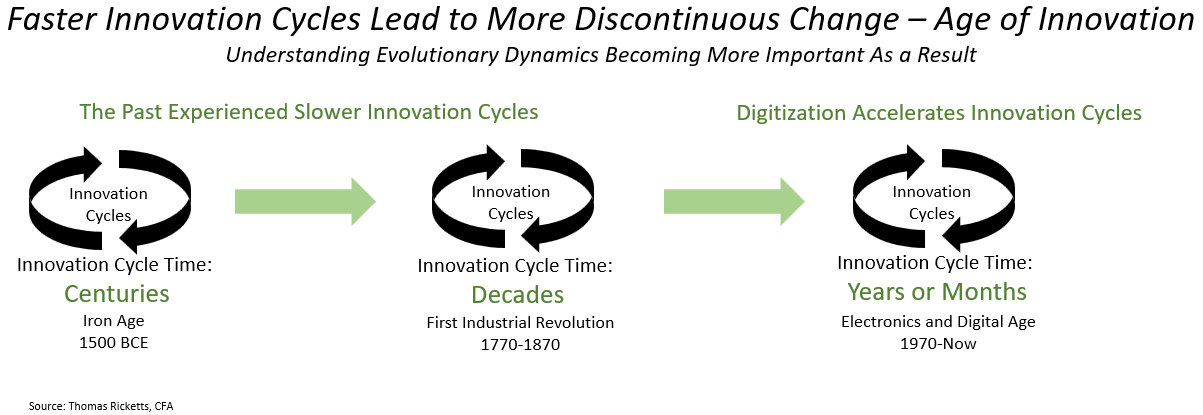

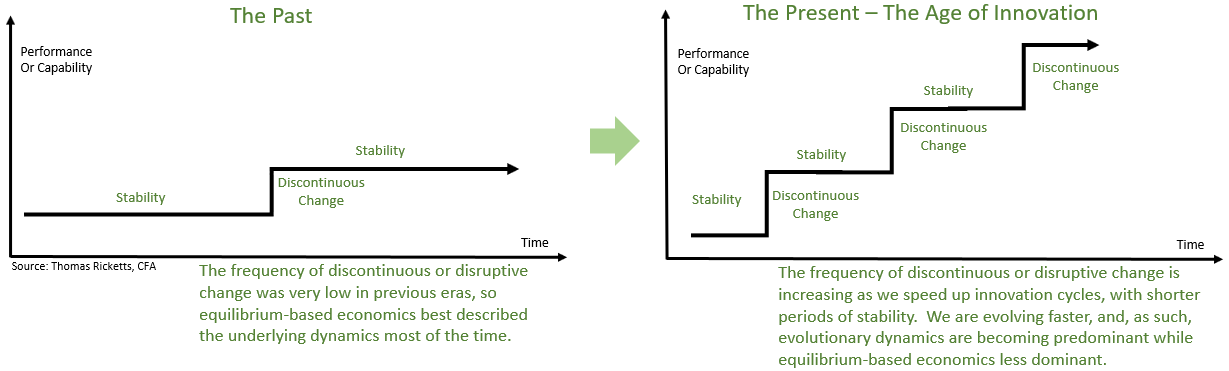

In an economy increasingly impacted by innovation, technological change, and evolutionary shifts, all industries face more periods of dis-equilibrium or disruption, relative to periods of equilibrium or stability than in the past. And, in the process these industries are often utterly transformed (see diagram below).

For example, the fact that consumers have wholesale shifted to taking photos with their Apple smartphones and sharing them on Instagram versus using standalone Sony cameras and having them developed on Kodak film is emblematic of this dynamic. There is no reversion to the mean for Kodak, there is only bankruptcy and replacement with the new. “Taking pictures” is now done in a completely new and digital way. The evolutionary economics approach best captures this pattern of change.

Traditional neoclassical economics that we were taught in college lacks the models and framework to deal with this dynamic. The same might be said for traditional investment methodologies that base at least part of their strategy on industrial-era equilibrium economics.

Importance of Evolutionary Economics and Technical Change to Long-term Investors

From the perspective of long-term investors, it can be argued that techno-evolutionary processes are the primary drivers of industry change, and this applies to both simple and complex products and services. To be clear, I define “technology” in broad terms, including the development of practical knowledge or new concepts, new techniques or designs, and new business models. Technology often is hidden in new business model designs and combinations of business or component building blocks that then surface in improved whole product and service offerings. Technology runs deep and wide, and this technical change is a profound force, especially as it evolves over time.

While these evolutionary processes may have been slower in the past, leaving longer periods of stability and obscuring their underlying importance and dynamics, this is no longer the case. Faster innovation cycles, the integration of rapidly-evolving software and intelligence into more products and services (the digitization process), and their attendant disruption are impacting more and more industries, and thus are more visible and more powerful (see diagram below).

Adapting the Theory of Evolution for Analyzing Businesses and Investments

While searching for insight by carefully studying Charles Darwin’s opus, On the Origin of Species, written in 1859, I found he was inspired by economic ideas swirling around the Victorian period.1 If Darwin can gain understanding of the natural world using analogies from economics and business, can we not take the opposite side of the coin and learn more about business by thinking in biological metaphors?

As I will show later, the mirror reflection of dynamics between nature and business is striking. A couple of Darwin’s quotes from On the Origin of Species illustrate this parallel (with my emphasis):

Owing to this struggle for life, any variation, however slight and from whatever cause preceding, if it be in any degree profitable to an individual of any species, in its infinitely complex relations to other organic beings and to external nature, will tend to the preservation of that individual.

Though nature grants vast periods of time for the work of natural selection, she does not grant an indefinite period; for as all organic beings are striving, it may be said, to seize on each place in the economy of nature, if any species does not become modified and improved in a corresponding degree with its competitors, it will soon be exterminated.

If evolutionary theories of economic and technical change are more insightful than mechanistic theories, how far can one take the analogy of evolution in its application to business analysis?

Let’s start with the invention of flight, which affords us a unique opportunity to compare natural innovation with human innovation. For animals, this capability developed out of reptile scales evolving into feathers, which in turn evolved into functional wings and, ultimately, a new class of animal, birds, capable of flight. This spiral of adaptive innovation and, in turn, relative competitive advantage for feathered reptiles (imagine the advantage of the ability to flee from predators that feathers and wings enabled) led to dramatic cumulative improvement in flight capability from the early archaeopteryx dinosaur with primitive wings to the mighty eagle soaring in the sky today.

Amazingly, the invention of human flight went through a similar spiral of innovation. It started with gliders and, after adding internal combustion engines and other innovations like wing flaps for lateral control, evolved to passenger planes capable of intercontinental travel for hundreds of passengers in a single flight. Like nature’s evolutionary process of innovation, companies build new capabilities and competitive advantages with new innovations, updated offerings, and business models, which feed on market success, seeing a similar spiral of cumulative advancement. Market success for one company forces competing firms to respond or cede share and be exterminated, to use Darwin’s phrase. This is the power of evolution.

Unlike bio-evolution, humans can engineer the evolution of technology, products, and services. This engineered evolution speeds up the evolutionary process, allowing humans to wield what I call active evolution (versus the passive evolution of nature). Nature, of course, has had the power of deep time to effect its change, but active evolution has the power of speed and cross-fertilization of ideas and building blocks. This active, designed, and engineered techno-evolution leads to fundamental progress across all products and services—at least for the innovative leading companies—and this progress leads to economic growth and wealth creation. It is this creative power that Evolutionary Investing seeks to harness to add value.

The power of techno-evolution leads to invention and innovation, which creates new industries over time. For example, the single invention of the airplane in 1903 by the Wright brothers spawned multiple industries built around components, assembly, servicing, financing, and its uses, including passenger travel, defense, and space exploration. If you add up the aerospace and air travel-related industries, the contribution to global GDP is nearly $1 trillion every year.

While it took biological evolution millions of years to develop full flight from mere gliding, humans developed controlled flight in slightly less than 100 years, from the first successful model glider (by Sir George Cayley in 1804) to the Wright Brother’s first successful, powered, heavier-than-air flight at Kitty Hawk in 1903. Amazingly, from Kitty Hawk, it took only another 66 years for humans to land a person on the Moon in 1969.

That is the power of innovation plus evolution over time. This was all built bottom-up over the past 100 years or so, and the series of flight innovations that developed and evolved over decades collectively in aggregate became an important contributor to economic growth. I ask you now to imagine how not one but thousands of different important innovations across all sectors of the economy can contribute to growth in the economy over time. This is the raw material that makes for fertile ground for finding value-added investments.

A New Model for the Evolution of Technology

The power of scientists, engineers, and entrepreneurs to combine and re-combine numerous building blocks across all fields of science and industry generates an explosion of continuous innovation, which creates potential opportunities for investors. While both bio and techno-evolution are progressive over time, technology evolution is orders of magnitude faster than bio-evolution, and this makes technology in the hands of creative humans such a powerful force. This force creates and destroys entire industries, and thereby creates or destroys wealth. Positioning an investment portfolio to benefit from the power of these innovations and resultant evolutionary shifts is the primary objective of Evolutionary Investing.

Let’s take a closer look at technology and the business world and see if we can draw parallels with biological evolution at a more granular level.

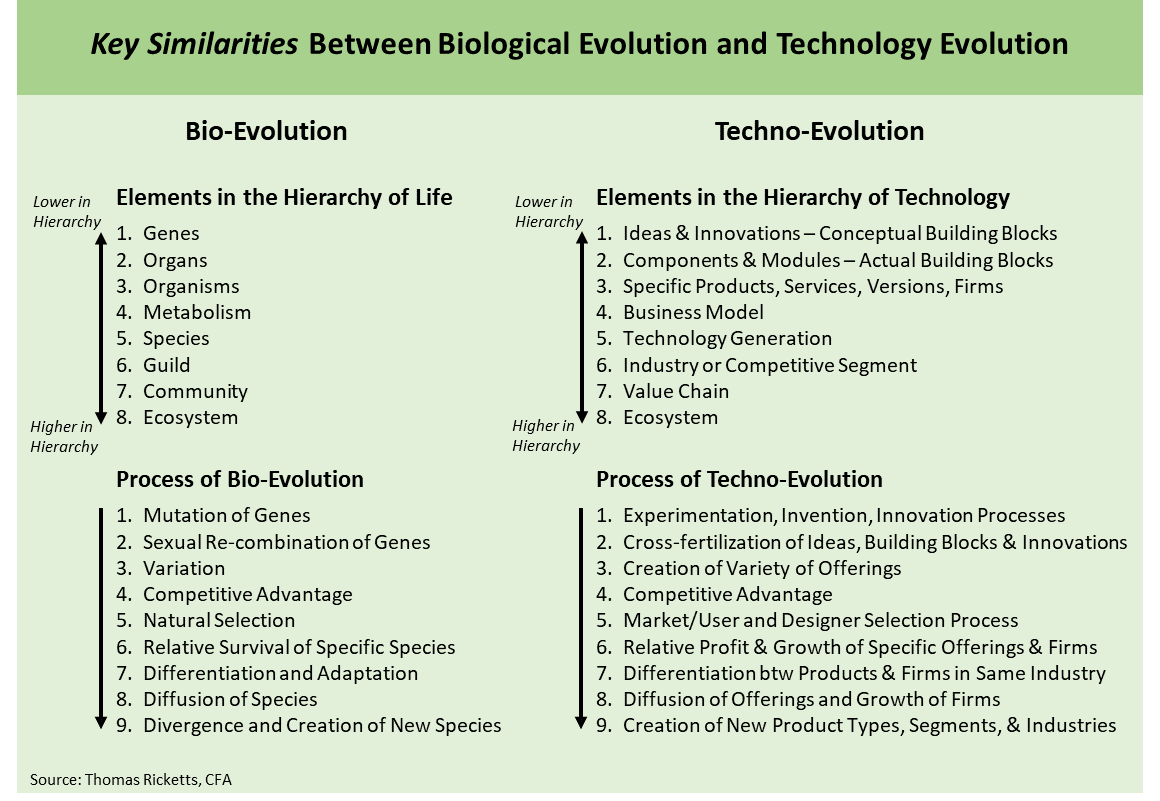

In biology and ecology there is a clear hierarchy of elements in nature, beginning with the most fundamental building block of genes, which, through development and expression, create and support organs and, in turn, whole organisms. Populations of similar organisms comprise species. Each species survives through its metabolism, which is a process of utilizing energy and resources to sustain life, and a key link with its environment. The renowned ecologist E.O. Wilson further delineated the biological hierarchy further, up to guilds (groups of species that exploit the same resources), communities (groups of interacting species living in the same space), and ecosystems (all living and non-living components within a habitat).2 Thus, the hierarchy is built bottom-up in the biological world from the micro (genes) to the macro (ecosystem). Importantly, it has been shown that all these levels evolve—actually co-evolve—over time.

With technologies—and I define this broadly, as knowledge, technology, and techniques that create economic value—we see strong similarities across the hierarchy. See the table below, which shows key similarities between bio and techno-evolution. In reviewing similarities, we see a structure that technologists call a nested hierarchy, with layers built on top of deeper layers in a holistic co-evolving system. The key point is the close parallel of technology and business versus the natural world. If technologies, broadly defined, are built on layers of elements that themselves evolve—such as components, business models, and offerings—then one begins to see how products, services, and industries evolve over time.

In techno-evolution, we begin at the lowest level of the hierarchy with conceptual building blocks of ideas and innovation concepts, the counterparts to genes in bio-evolution. Ideas can come in infinite forms (providing variety), can be chosen by engineers and the market (creating selection dynamics), and can be passed on through learning or imitation (retention or replication). Ideas build up into constructs, as ideas inform the design and construction of components and modules (incorporated into products or service offerings). The (re)combination of various components and modules is what creates specific new products, services, processes, and even firms. Moving higher in the hierarchy, the metabolism of a firm is what we might call a business model, with revenues and profits serving as the energy sustaining the firm through its lifecycle and the link to its environment of the market of users and competitors. Further, specific products or services at a point in time are akin to technology generations. Higher still, we see populations of products or services, which within the business world comprise the upper ecological levels of the industry, value chain, and ecosystem.

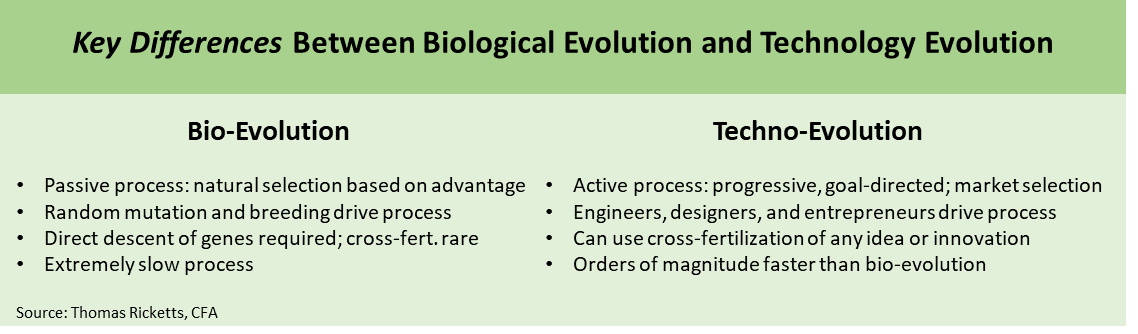

While there are strong similarities between bio and techno-evolution, there are also a number of key differences (shown in the table below). The two most important differences are that techno-evolution is an active process and is significantly faster than bio-evolution.

Turning to an example, Apple best illustrates the hierarchy of techno-evolution from a kernel of an idea up to the broader ecosystem the company has built. Steve Jobs and Steve Wozniak, inspired by computer hobbyists of the Homebrew Club they belonged to in the mid-70s, experimented with early ideas of simpler computers compared to the corporate mainframes and minicomputers of their time. They built on the idea of computing kits by developing simpler and more standardized computers that could be used by people beyond the temple of mainframe experts. These ideas and their physical manifestation in early generations of computers, such as the Apple II or the Macintosh, evolved into the powerful computers, smartphones, and other computing devices we use today. Apple has continually launched new products and services, not through magic, but by incorporating new components or modules over time, such as the touchscreen for the smartphone or iTunes to access music. As components, such as microprocessors, mobile communication chips, or artificial intelligence, are developed and continually evolve, they in turn enable evolution at higher levels of the product or service offering. Successful product variations, selected by the market and users, produce the profits to fund further development at the company level. Companies compete with each other at the industry level, are a part of value chains, and increasingly belong to and support specific ecosystems. Apple is the epitome of a company taking full advantage of these dynamics, as are other leading innovators like Amazon or Google.

Like bio-evolution, all levels of techno-evolution can and will evolve over time. A key point is that the amorphous “change” that investors seek out, actually happens—evolves—within each of these levels of the nested hierarchy. Evolution happens at the component level, at the product/service level, at the business model level, and on up.

The Basic Model for the Evolution of Technology

Now that I have the made the case for the importance of evolutionary change and the elements of technology evolution relative to bio-evolution, let’s look at how the process actually works.

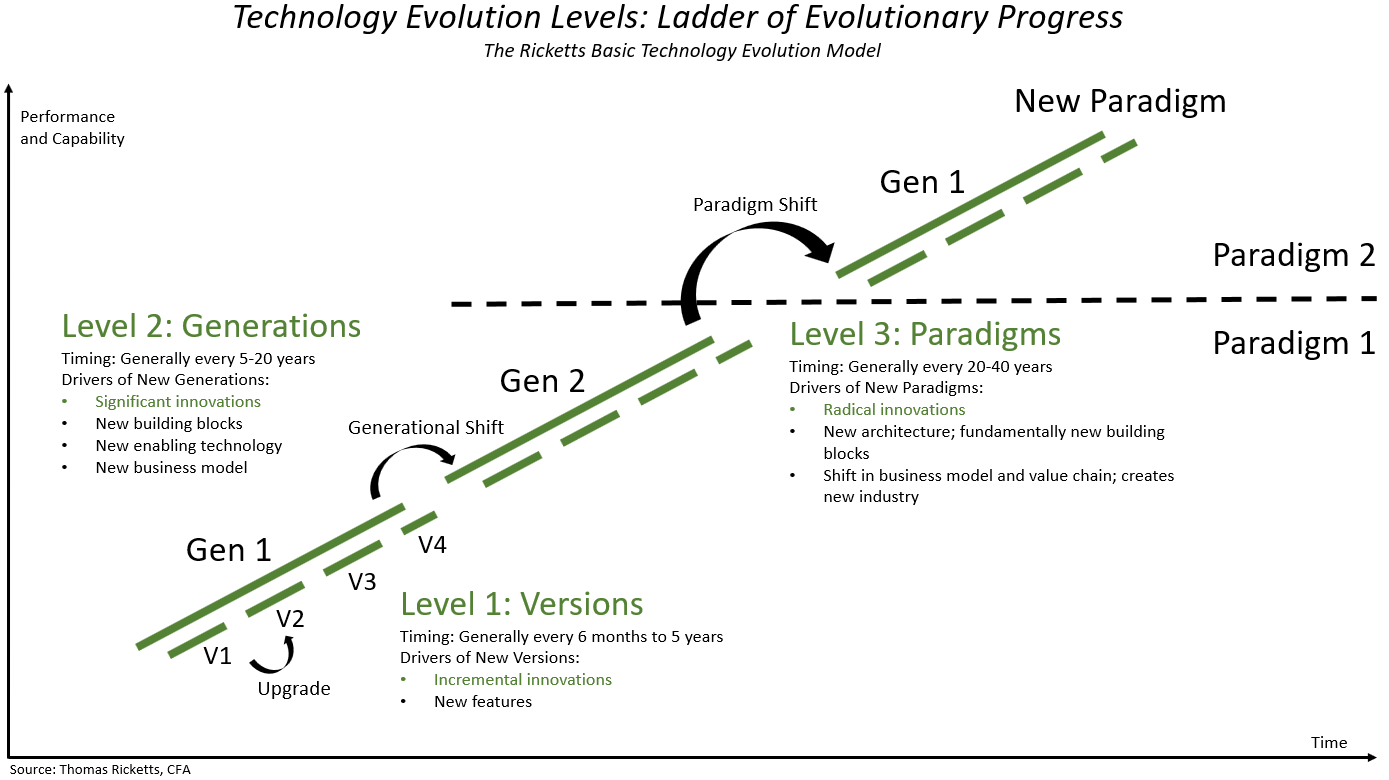

Technology development can be thought of as progressing through three basic levels of hierarchy, with versions at the bottom, generations in the middle, and paradigms at the top (see diagram below). Each has a different timescale and relative strength of impact of the underlying innovation.

At the lowest level are versions. A version is simply a new iteration of the technology or offering, and usually only adds one or a few new incremental innovations to the prior version (e.g. think iPhone 6 versus 5). Most new products you see are usually just new iterations, or incremental new versions. From a timing point of view, new versions are typically released every 6 months to 5 years, depending on the industry. A new version is called an upgrade. This is the lowest level of the basic model of evolution, and one that most investors tend to focus on. However, the real power for sustainable profit growth comes from riding the higher levels of the tech evolution model, at the generation and paradigm levels.

At the next level in the hierarchy are technology generations. Technology generations typically last from 5-20 years, depending on the underlying technologies involved. Each generation progresses through a series of versions that add incremental innovations. With, however, enough incremental innovation plus a more substantial innovation or new building block, we begin to mark the shift to a new generation (e.g., shifting from 2G to 3G cell phone technology). It usually takes significant innovation and/or cumulative innovation of prior versions to mark a shift from one generation to another. For the investor, the multi-year adoption cycle of a new generation can drive significant investment returns, particularly if a leading company is able to capitalize on this generational shift.

At the highest level of technology evolution is the paradigm. The concept of the paradigm shift comes from Thomas Kuhn in his seminal book written in 1962, The Structure of Scientific Revolutions, where he described how scientific fields advance through paradigms.3 He believed that paradigms are organizing frameworks that best describe a field at a point in time, and that a change to a new paradigm happens when a radically new organizing framework demonstrates better explanatory power, displacing the old paradigm, thus creating a paradigm shift.

This paradigm concept has been applied to technology and is best thought of as comprising the fundamental building blocks and core architecture of a given state of technology. A key point is that a shift to a new technology paradigm marks a discontinuous technological change. Discontinuous means a wholesale change from one architecture to a radically different and new one, where new building blocks within a new architecture serve the function of the prior paradigm. These are often called radical innovations. For example, the shift from the Sony + Kodak picture-taking paradigm to the iPhone + Instagram paradigm for taking pictures makes this dynamic clear. Paradigm shifts typically happen every 20-40 years, and are therefore much less common than new generations, which are, in turn, less common than new versions. The key is that the power of wealth creation is tied to new generations and paradigms—driven by generational and paradigm shifts that disrupt the old and usher in the new.

Because most investors tend to focus on the short-term, usually on events and drivers lasting fewer than two years, they by default are focusing at the version level. I believe, however, that the more significant long-term wealth creation is at the higher levels of evolution, at the generation and paradigm levels. This is easier said than done, of course, as it takes a long-term investment horizon and a patient temperament to benefit from the higher levels of technology evolution.

The Technology and Industry Evolution Model

With this basic backdrop of how technologies evolve through version upgrades, generational shifts, and paradigm shifts in mind, let’s dive deeper into this process. While there are existing models for the growth of industries, such as the S Curve or the Adoption Cycle, none ties industry growth and adoption to the evolution of the underlying technology.4 The more I studied the development of various industries, the more it was clear a new model was needed. I call this the Technology and Industry Evolution Model. This model has 16 phases, from invention through the creation of a new paradigm (see diagram below).

The evolution of technologies and techniques generally moves through stages and can take decades. Technologies don’t come into the world fully formed; rather, they start as ideas, often built on newly discovered principles or concepts, new tools and techniques, and new enabling building blocks. Scientists, experimenters, engineers, and business designers bring these together and create proof-of-concept prototypes, which take years of gestation to become ready for the marketplace. Think of the first five phases of the evolution of technology as “The Development of a New Concept” (Box A).

Gestation of prototypes and experimentation by hobbyists eventually cross the divide and create what I call The Primitives, which are early commercialization attempts that don’t go mainstream. However, one design eventually breaks out into what I call Gen 1 (first-generation) technology, achieving early mainstream success. These phases comprise the “Emergence of the Industry with the First Generation” (Box B), the period of early industry development.

They say that you should never buy a new model car, because they haven’t worked out all the kinks. This is the same dynamic that plagues Gen 1 technologies. While they functionally work and create initial market demand, users begin to experience a number of issues and problems. This is quite natural, given that the technology is new, both in design and in its application in the real world. As consumers use the new product or service and push its limits, its shortcomings become apparent. I call this phase CHIPS, an acronym for Challenges, Hurdles, Issues, Problems, and Setbacks.

The first generation launched the industry and moved the underlying technology or offering into the mainstream. But, inevitably, the usage of Gen 1 offerings in the real world reveals as much about their shortcomings as their utility. These shortcomings are specific to the product or service offering, and are usually multiple in nature, and thus future generations are needed to address these challenges and issues. New innovations and solutions to specific CHIPs of the Gen 1 offering lead to second-generation technology, or Gen 2, the next phase in the evolution of technology. Over time, a specific Gen 2 design brings together the critical elements in the right combination and becomes the standard, or what academics call a Dominant Design.5 The CHIPS and Gen 2 phases, plus others, comprise the “Second Generation and Emergence of the Dominant Design” period (Box C). Dominant companies often emerge during this period.

Multiple waves of generations are possible, but eventually a specific paradigm hits its natural performance and functional limits. For example, while vacuum tubes enabled the first computers in the 1940s and 50s, they were simply too bulky and inefficient to enable the high performance (and smaller) computers we have today. It took a paradigm change to a radically new technology called the transistor—and follow-on generations of microchips through microprocessors—to enable more advanced mainframes and eventually personal computers.

When an existing paradigm hits its natural limits, a concerted push is made by engineers, entrepreneurs, and even technology users to explore and find a new paradigm to break through. The emergence of a “New Paradigm” (Box D) is what restarts the entire technology evolution cycle all over again, and, of course, this starts with new Principles, Tools, and New Building Blocks that enable the new paradigm. The evolution of technology never ends. The cycle is always pushing progress forward, and this creates new investment opportunities.

Evolution is a Process of Replacement Over Time

The big picture is really one of newer generations of technology (or offerings and business models) replacing older ones over the long term. Elliott Montroll, at the University of Rochester, wrote in 1978 in Social Dynamics and the Quantifying of Social Forces, that: “Social and industrial evolutionary processes are considered to be a sequence of replacements or substitutions: new ideas for old, new labor patterns for old, new technologies for old…evolution is the result of a sequence of replacements.”6

Our model below illustrates how this cycle of replacement works.

When new generations of technologies, products, services, and/or business models challenge current generations (e.g., when Gen 2 challenges Gen 1), the process over the very long term is a replacement process with three phases:

- Co-existence phase: Gen 2 and Gen 1 co-exist alongside each other in the initial stages, often because Gen 2 serves a fringe market or is too expensive, or simply not ready for primetime mass adoption. Gen 1 companies may still grow during this phase and not feel threatened, but like the proverbial frog they are being slowly cooked as Gen 2 gestates.

- Displacement phase: As Gen 2 gains wider adoption due to improved performance, lower costs, and greater awareness, it begins to displace Gen 1 in earnest, such that Gen 1 sales may begin to flatten or decline.

- Replacement phase: As Gen 2 over time becomes accepted as the superior solution to Gen 1 offerings, it may come to replace the previous generation. Often this is not a complete replacement, but a de facto one as Gen 1 technology becomes largely irrelevant and retains only a miniscule share of the market.

The shift to e-commerce from more traditional brick-and-mortar retailers is a classic example of the power of new business model innovation and the replacement cycle. The history of retail starts with mom and pop stores, which have largely been replaced first by department stores and mall-based stores, and later with big discounters. Over time, however, the brick-and-mortar stores hit their natural paradigm limit in the number of products they could fit within four walls, and the development of Web 2.0 technologies and supporting infrastructure of logistics and electronic payments enabled the rise of the e-commerce paradigm. This paradigm is now displacing all previous retail business models that came before it. The shift is on.

From the Evolution of Technologies to the Evolution of Industries and Economies

The evolution of technology—of thousands of individual technologies, techniques, and business models across the economy—is the primary long-term driver of the economy. This explosion and ever-diversifying nature of innovation is the underlying driver of the economic wheel of progress.

A natural consequence of invention and continuing and cumulative innovation is the creation of new industries and, in turn, their evolution over time. The underlying technological architecture provides the foundation of the new industry, where business models and the competitive field are built over time. The underlying technology, be it a product or service offering, evolves through progressive generations and paradigms. Shifts from one generation to the next, or from one paradigm to the next, are what fundamentally drives the evolution and growth of industries.

The invention of a new technology or offering, particularly at the Gen 1 phase, marks the birth of an industry. Over time, the commercial success of a new invention draws in new entrants, creating a Cambrian explosion of not only new companies, but new designs and offerings, all seeking to become the standard bearer, and if fortunate, the dominant design. Over time, with each new generation of offering, greater performance, new capabilities, and often lower costs drive the adoption of a technology into the mainstream, fueling the growth of the industry. Collections of related industries, in turn, drive progress and growth of whole sectors. This largely bottom-up, organic, and emergent process is what, in turn, drives entire economies. The “macro” economy can then be viewed as the accumulated layering of all these evolving innovations, industries, and sectors. In fact, much of what we call macro is really an aggregate outcome, rather than the driver.

Joseph Schumpeter’s idea of “creative destruction” laid the first contours of this worldview. Schumpeter states in Capitalism, Socialism, and Democracy, written in 1942:

The essential point to grasp is that in dealing with capitalism we are dealing with an evolutionary process…The fundamental impulse that sets and keeps the capitalist engine in motion comes from the new consumers’ goods, new methods of production or transportation, the new markets, the new forms of industrial organization that capitalist enterprise creates…The opening up of new markets, foreign or domestic, and the organizational development from the craft shop and factory…illustrate the same process of industrial mutation—if I may use that biological term—that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one. This process of Creative Destruction is the essential fact about capitalism.7

How the evolution of technology builds up into an economy can be conceptualized in the diagram below. Think of the economy as vertically-stacked layers of industry S curves making up the strata of the economy, with the lowest layers the oldest and typically most commoditized. Higher up the economic stack is the addition of new industries and offerings, built on the frontier of science and entrepreneurship—on the innovation frontier. New industries build on existing technologies, processes, and business models and create new layers of value (revenues, profit) that collectively add up vertically to comprise the gross domestic product (GDP).

Aggregate macro statistics show almost placid growth over time (most advanced economies grow on average 1-3% per year), with periodic recessions of modest low-single-digit declines in production and GDP. This placid pace of change at the aggregate macro level masks dramatic creative destruction below the surface at the industry/sector level, at what evolutionary economists call the “meso level.” In my opinion, the real action is at both the bottom-up (inventions, innovations, business models, companies) and meso (industries, ecosystems, and sectors) levels within our economy. This is where the forces of creative destruction occur.

Evolutionary Investing as a New Philosophy

Evolutionary Investing as a new philosophy builds on the important investing concepts of sustainable growth and competitive advantage by adding a critical new dimension of tracking the evolution of technologies, business models, and industries.

A selective and concentrated portfolio management approach, when performed with a focus on innovation and evolution, is best positioned to take advantage of the evolutionary shifts across our economy. Profound and investable innovation, where a leading company is able to capture value creation, is rare; therefore, concentrated active strategies are the best way to take advantage of these types of investment opportunities.

Evolutionary-focused research gets at the heart of identifying future levers of earnings growth, the key driver of investment results over the long term. Understanding what drives long-term growth in earnings is what really matters. Technological evolution, and the underlying and never-ending series of innovations across the hierarchy of business life, is the root cause of growth and the ultimate long-term creator of wealth. This has always been the case, but the world we live in today, this Age of Innovation, is making this dynamic more relevant than ever.

Sources:

- Darwin, Charles. On the Origin of Species. London: John Murray, 1859.

- Wilson, Edward. The Diversity of Life. New York: W.W. Norton Press, 1993.

- Kuhn, Thomas. The Structure of Scientific Revolutions. Chicago: The University of Chicago Press, 1962.

- Rogers, Everett. Diffusion of Innovations. New York: Free Press, 1962.

- Srinivasan, Raji, Gary Lilien, and Arvind Rangaswamy. “The Emergence of Dominant Designs.” Journal of Marketing. Volume 70 (April 2006): 1-17.

- Montroll, Elliott. “Social Dynamics and the Quantifying of Social Forces.” Proceedings of National Academy of Sciences. Volume 75. Number 10 (4633-4637). October 1978.

- Schumpeter, Joseph. Capital, Socialism, and Democracy. New York: Harper & Row Publishers. 1942.

Disclosure: These White Papers are meant for informational purposes only. The mention or discussion of specific industries, companies, or stocks in this or other White Papers does not constitute a recommendation to buy, sell, or take other investment action with, a particular security. We reference companies or industries to provide examples of topics being discussed. There can be no assurance that we have owned, currently own, or will own any of the companies or industries mentioned in this or other white papers or articles.

All rights reserved © 2017 Thomas M. Ricketts