Part One of a Three-Part White Paper Series

By Thomas Ricketts, CFA

The Rise of Intellectual Capital and the Shift to Intangibles Reflect the Age of Innovation

We live in the Age of Innovation. This era is built increasingly on intellectual capital as the value of ideas and concepts displaces the value of land (as seen in the age of agriculture) or even capital (in the industrial age). Others call our current era the Digital Age, but the result is the same, a growing array of innovations across all industries that increases the pace of change and the evolution of technologies, products and services, and industries.

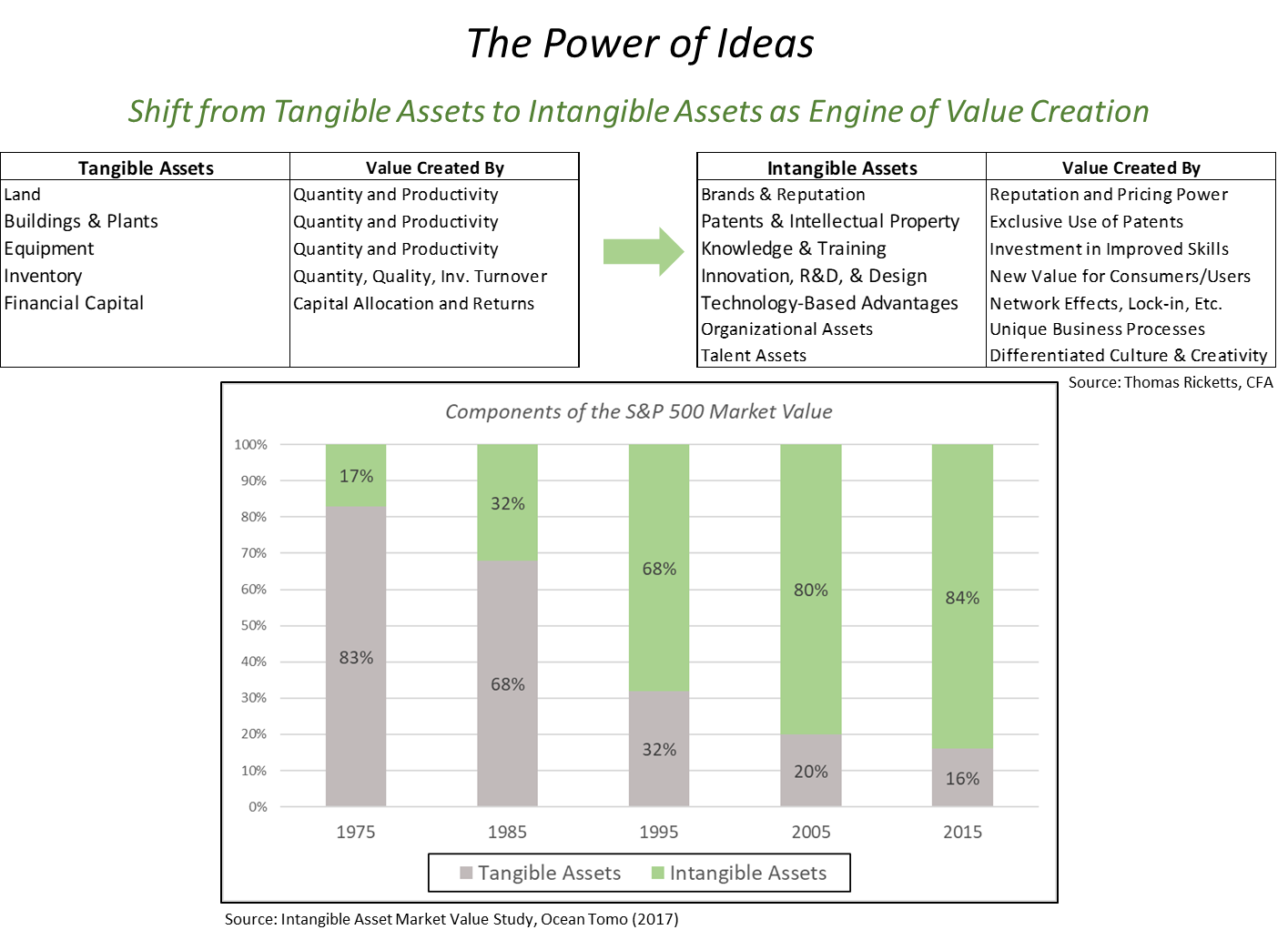

The most striking illustration of the shift from a tangibles-based economy to an intellectual capital or intangibles-based economy is shown by the shifting components of value in the S&P 500 index (see graphic below).1 As recently as 1975, tangible assets—those assets that include plant, equipment, inventory, and financial capital—made up 83% of the market value of the index and intangibles a mere 17%. With the rise of the digital age, the percentage of value represented by intangibles—those assets that include intellectual property, brands, innovation, and differentiated business processes—rose to 68% by 1995 and 84% by 2015.2 The intangible tail is now wagging the tangible dog. This shift from a tangibles-based economy to one dominated by intangibles reflects the power of ideas and the rise of the Age of Innovation.

The rise of intangibles naturally leads to the growing importance of creating new intellectual property (the domain of research and development), along with new marketing innovations. In a growing number of academic studies, data shows that R&D-intensive industries allow for greater persistence and profitability for market share leaders.3

The bottom line of these studies is that industries and companies with a higher level of research productivity, using innovation as the output, are correlated with strong growth and profitability. Furthermore, in industries where high levels of technology are embedded in the product or service offering, there is a tendency for the leading company to capture more of the economics. As a result, we are seeing increasing concentration across a growing number of industries.

A recent academic article entitled “The Fall of Labor Share and the Rise of Superstar Firms” describes how industries are increasingly “characterized by a ‘winner take most’ feature where a small number of firms gain a very large share of the market…markets have changed such that firms with superior quality, lower costs, or greater innovation reap disproportionate rewards relative to prior eras.”4

Growth Opportunities Are Found on the Innovation Frontier

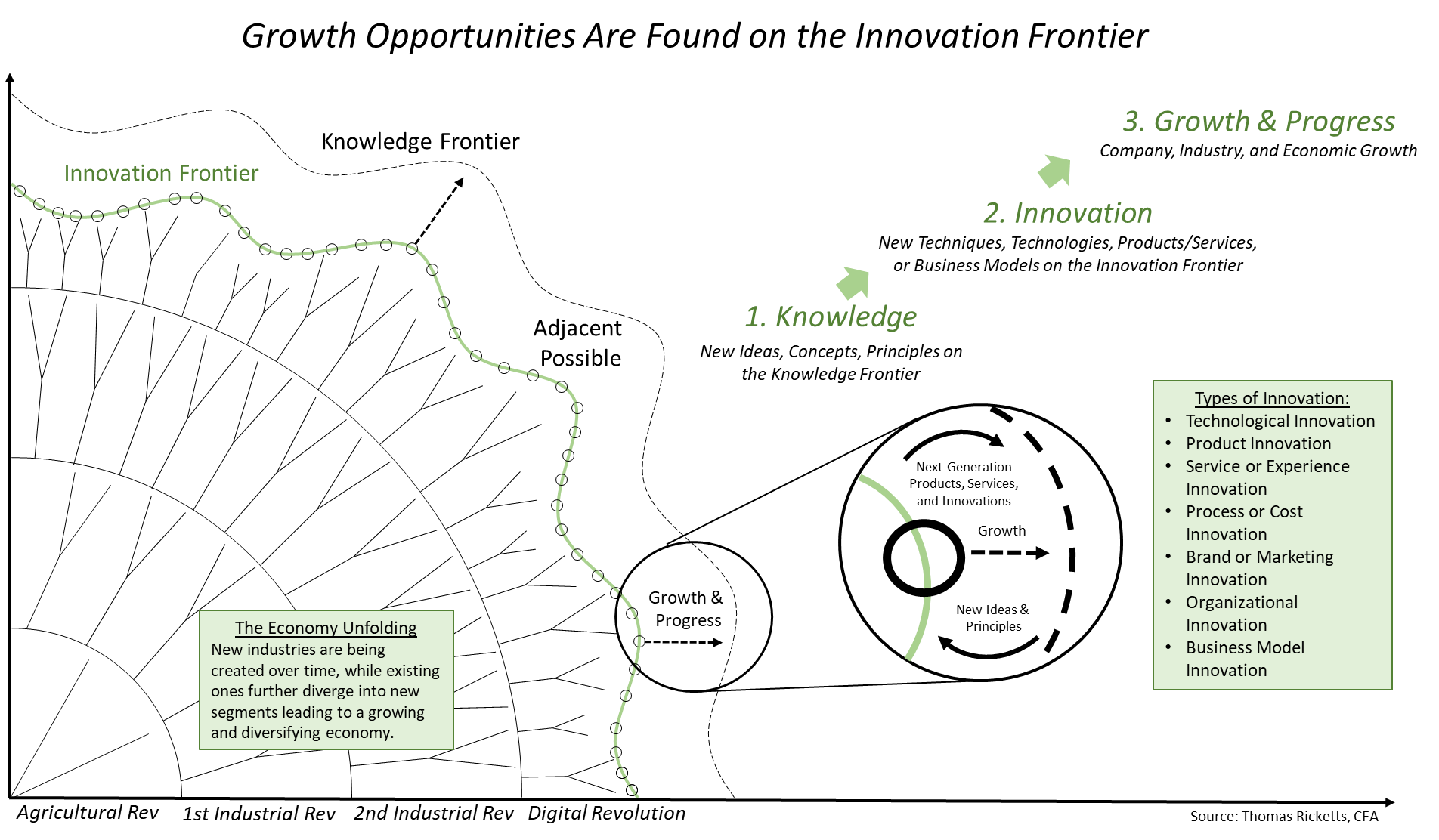

In the Age of Innovation, where can investors find opportunity? Conceptually, opportunity lies on the boundary of progress, on what I describe as the innovation frontier (see diagram below).

The innovation frontier defines the current optimized technology, technique, and best practice in a given industry or field, as applied knowledge embodied in leading product and service offerings. This can be thought of as the current state of evolution. Beyond this frontier is the knowledge frontier, which always advances ahead of innovation. This region represents how our bodies of knowledge in current and new fields are developing new ideas, insights, and principles. The gap between these two frontiers—between the innovation frontier and the knowledge frontier—is where applied research, development, and new innovation happens. Historians of technology call this special place the adjacent possible, as it defines what is potentially possible in the near future with a given state of technology. This delineates the future potential path of evolution, or technological trajectory, and is where future opportunity can be found.

The knowledge frontier continually feeds the innovation frontier with new building blocks, such as new principles of knowledge, enabling technology, and new concepts and ideas. These can be combined with existing generations of product and service offerings to create next-generation offerings, or even new paradigms, which then push the innovation frontier forward. This is the fundamental basis for technological and economic progress and growth.

Searching for Investable Innovation on the Innovation Frontier

Despite continual progress across the innovation frontier, not all new innovations are investable or profitable. Some innovations never develop into mainstream offerings or in other circumstances competitors imitate each innovation, so no one firm is able to earn sustainable above-average profits or returns. As a result of this dynamic, it is important to search for what I call investable innovations, where imitation is difficult and a standout industry leader can potentially capture the long-term revenue growth and profit potential as the industry grows over time.

Investable innovations are those innovations that I believe are ready for mainstream adoption, provide important value and impact to users, cannot be easily replicated or imitated by competitors, and the value being created can be captured by the lead innovator. Types of innovations that contribute to sustainable growth and leadership include technological innovation, product innovation, service or experience innovation, process or cost innovation, brand or marketing innovation, organizational innovation, and/or business model innovation. The power of this dynamic is enhanced when multiple innovations are combined into a unique offering, or in delivering a whole series of innovations over time.

Skeptics might say that focusing too much on innovation is unnecessary, and that innovation doesn’t apply to all industries or sectors. To that, I would offer three points. First, if you have an industry that is not experiencing innovation, then you are looking at an industry that is likely mature, commoditized, and less able to create new value for consumers. If you aren’t creating new value for consumers, then it is difficult to drive sustained wealth creation. Second, even in industries that don’t on the surface appear to have significant innovation, when you look closer and find the right dimension, you discover the contours of long-term innovation. Third, as all industries undergo digital transformation, the ability to innovate more broadly has increased. Foregoing innovation is no longer a choice as the penalty for not innovating is going up.

For example, take two industries that seem devoid of innovation, financial services and airline carriers. While banking should probably be wary of fancy new innovation (remember sub-prime, anyone?), there are a number of important innovations, industry trends, and evolutionary shifts affecting it, including the shift toward electronic payments, online banking, and the rise of ETFs. Leading innovators will be pushing these innovations forward for the benefit of their users, and, in turn, may create value for investors.

Likewise, for airline carriers. The two biggest trends affecting airline carriers are the rise of low-cost airline services (think Southwest) and the increasing focus by consumers on experiences, which spur continued global growth in travel. Southwest has created a unique business model innovation by optimizing its service to deliver the lowest prices for travelers, a low-cost position that the major airline carriers have failed to replicate (despite a number of attempts). Southwest standardizes on one type of plane and has streamlined its boarding procedures to turn planes around quickly and maintain maximum utilization. Further, it uses lower-cost, second-tier airports (regional point-to-point model versus traditional hub-and-spoke model) that enable Southwest to further lower costs. Innovation can be found everywhere.

At the Fork in the Road, Choose Innovation

In our current era, innovation is as important as ever for growth, productivity, and wealth creation. Kevin Hassett and Robert Shapiro provide support for this proposition in their study, “What Ideas are Worth:”

[MIT economist Robert] Solow along with Edward Denison and others found that at least 30 percent of the economic gains achieved in the United States in the 20th century can be traced to economic innovation, encompassing not only new technologies, materials and processes, but also new ways of financing, marketing and distributing goods, and new approaches to organizing a business and managing the workplace. By contrast, increases in the economy’s capital stock can explain only 10 percent to 15 percent of those gains…5

With the creation of many new technologies, enablers, and other building blocks that feed into innovation, it seems reasonable to assume that this rate of contribution by innovation will be sustained and may increase.

In a thought experiment, think of two companies, one company that has chosen the path of greater experimentation and innovation, and another company that maintains the status quo with little investment in innovation. Now imagine these two companies competing head-on. Which company would you invest in?

In this white paper, we discussed the rise of intellectual capital and intangibles—the power of ideas—and how these may be reflected in investable innovation. Increasingly we live in the Age of Innovation, and this creates investment opportunities in select situations.

At a deeper level, I believe that innovation is only part of the story. Stepping back, one can discern that products and services, even industries, evolve over time, driven by a series of innovations. We explore this dynamic in our next white paper, entitled “On Evolutionary Investing.” Given that innovations are not uniformly ready for primetime or investable, we discuss a framework on how to navigate the explosion of innovation and find those that are investable in the third and last white paper, entitled “Navigating the Innovation Hype-Readiness Continuum.”

Sources:

- Corrado, Carol, Charles Hulten, and Daniel Sichel. “Intangible Capital and U.S. Economic Growth.” The Review of Income and Wealth. Series 55. Number 3 (Sept 2009).

- Ocean Tomo. “Intangible Asset Market Value Study.” OceanTomo.com website. 2018.

- Klepper, Steven. “Entry, Exit, Growth, and Innovation Over the Product Life Cycle.” The American Economic Review. Volume 86. Number 3 (June 1996): 562-583.

- Autor, David, David Dorn, Lawrence Katz, Christina Patterson, and John Van Reenen. “The Fall of the Labor Share and the Rise of Superstar Firms.” Research funded by National Science Foundation and National Bureau of Economic Research. May 2017.

- Hassett, Kevin, and Robert Shapiro. “What Ideas are Worth: The Value of Intellectual Capital and Intangible Assets in the American Economy.” Sonecon LLC. 2011.

Disclosure: These White Papers are meant for informational purposes only. The mention or discussion of specific industries, companies, or stocks in this or other White Papers does not constitute a recommendation to buy, sell, or take other investment action with, a particular security. We reference companies or industries to provide examples of topics being discussed. There can be no assurance that we have owned, currently own, or will own any of the companies or industries mentioned in this or other white papers or articles.

All rights reserved © 2017 Thomas M. Ricketts